A lease-to-own contract is a hybrid agreement combining rental terms with a purchase option, allowing tenants to rent property with the possibility of buying it later. This arrangement benefits tenants who need time to secure financing and landlords seeking long-term tenants. It outlines property details, rental terms, and purchase conditions, ensuring clarity for both parties. Key elements include property description, lease duration, payment terms, and purchase options, making it a flexible and mutually beneficial arrangement.

What is a Lease-to-Own Contract?

A lease-to-own contract, also known as a rent-to-own agreement, is a legal document that combines elements of a lease and a purchase option. It allows a tenant to rent a property for a specified period with the exclusive right to purchase it during or at the end of the lease term. This contract outlines the terms, including property details, lease duration, rent payments, and purchase conditions, ensuring clarity and mutual understanding between the tenant and landlord. It is a flexible arrangement that provides tenants with an opportunity to transition from renting to homeownership while offering landlords potential long-term stability.

Importance of a Lease-to-Own Agreement

A lease-to-own agreement is a mutually beneficial arrangement for both tenants and landlords. It provides tenants with the opportunity to rent a property while working toward homeownership, allowing them to build equity over time. For landlords, it offers a stable tenant base and potential long-term property sale. This agreement is particularly advantageous for tenants who need time to improve their financial situation or credit score before purchasing. It also ensures clarity and legal protection for both parties, outlining responsibilities and expectations. Ultimately, it serves as a win-win solution, balancing flexibility with a clear path to property ownership.

Key Elements of a Lease-to-Own Contract

A lease-to-own contract includes property description, lease term, rent details, payment terms, option fee, purchase price, and maintenance responsibilities. These elements ensure clarity and protect both parties’ interests.

Property Description

The property description in a lease-to-own contract outlines the specifics of the rental property, including its address, type (house, apartment, or condo), and any unique features. It may also detail the condition of the property, the number of bedrooms and bathrooms, square footage, and any included amenities such as a backyard, garage, or shared spaces. This section ensures both parties have a clear understanding of the property being rented and, potentially, purchased. It is essential for setting realistic expectations and preventing future disputes.

Lease Term and Option to Purchase

The lease term specifies the duration of the rental agreement, typically ranging from one to five years, during which the tenant occupies the property. The option to purchase grants the tenant the exclusive right to buy the property at a predetermined price within the lease term. This option is usually exercisable at any time during the lease or at its end. The terms may include an option fee, which is often credited toward the purchase price if the tenant exercises the option. If the tenant does not purchase, the fee is retained by the landlord. This structure provides clarity and security for both parties.

Rent and Payment Terms

Rent and payment terms outline the amount, frequency, and due date for rental payments. Typically, rent is paid monthly, with late fees applied if payments are overdue. The agreement may specify acceptable payment methods, such as checks, bank transfers, or online platforms. In some cases, a portion of the rent is allocated as a credit toward the purchase price if the tenant exercises the option to buy. Clear payment terms ensure both parties understand their financial obligations, maintaining a smooth rental relationship and providing a pathway for potential homeownership. Proper documentation of these terms is essential for accountability and clarity.

Option Fee and Purchase Price

The option fee is a non-refundable payment granting the tenant the exclusive right to purchase the property during the lease term. It is typically a percentage of the purchase price and varies based on negotiations. The purchase price is the agreed-upon amount the tenant will pay if they exercise the option to buy. In some agreements, a portion of the rent payments may be applied toward the purchase price. The option fee and purchase price are structured to incentivize tenants to pursue ownership while providing landlords with financial security. Clear terms ensure both parties understand the financial obligations and pathways to ownership.

Maintenance and Repair Responsibilities

In a lease-to-own contract, maintenance and repair responsibilities are typically outlined to clarify obligations for both parties. Generally, tenants are responsible for routine maintenance, such as minor repairs and upkeep, to ensure the property remains in good condition. Landlords may handle structural or major repairs, unless caused by tenant negligence. The agreement often specifies these duties to avoid disputes. Tenants, having a potential ownership interest, are incentivized to maintain the property well. Clear terms ensure both parties understand their roles in preserving the property’s value and functionality during the lease period.

Default and Termination Clauses

Lease-to-own contracts often include default and termination clauses to address potential breaches by either party. These clauses outline the conditions under which the agreement can be terminated, such as non-payment of rent or option fees by the tenant, or failure by the landlord to meet their obligations. In the event of a default, the landlord typically reserves the right to terminate the agreement, which may result in the tenant losing their option to purchase and any associated fees or credits. These clauses ensure both parties are protected and provide clarity on the consequences of non-compliance, maintaining fairness in the arrangement.

Benefits of a Lease-to-Own Agreement

A lease-to-own agreement provides tenants a pathway to homeownership while offering landlords stable income. It bridges the gap between renting and buying, benefiting both parties financially long-term.

Advantages for Tenants

A lease-to-own contract offers tenants a pathway to homeownership, allowing them to rent a property with the option to purchase it in the future. This arrangement provides tenants with time to improve their financial situation or credit score, increasing their chances of securing a mortgage. A portion of the monthly rent may be applied toward the purchase price, reducing the upfront costs. Tenants also benefit from stability, as they can live in the property while deciding whether to buy it. This option is ideal for those who need more time to prepare for homeownership but want to start building equity.

Advantages for Landlords

A lease-to-own contract appeals to landlords seeking stable, long-term tenants. It attracts tenants who are serious about ownership, reducing turnover and vacancy risks. Landlords benefit from consistent rental income while retaining property ownership during the lease term. A portion of the rent may be allocated as a credit toward the purchase price, incentivizing tenants to maintain the property. This arrangement also allows landlords to potentially sell the property without incurring real estate agent fees. It offers a balance between rental income and the eventual sale of the property, making it a financially attractive option for landlords.

How to Create a Lease-to-Own Contract

Start by using a lease-to-own contract template, customizing it with property details, lease terms, and purchase options. Include rent, payment terms, and responsibilities, ensuring legal compliance and clarity for both parties.

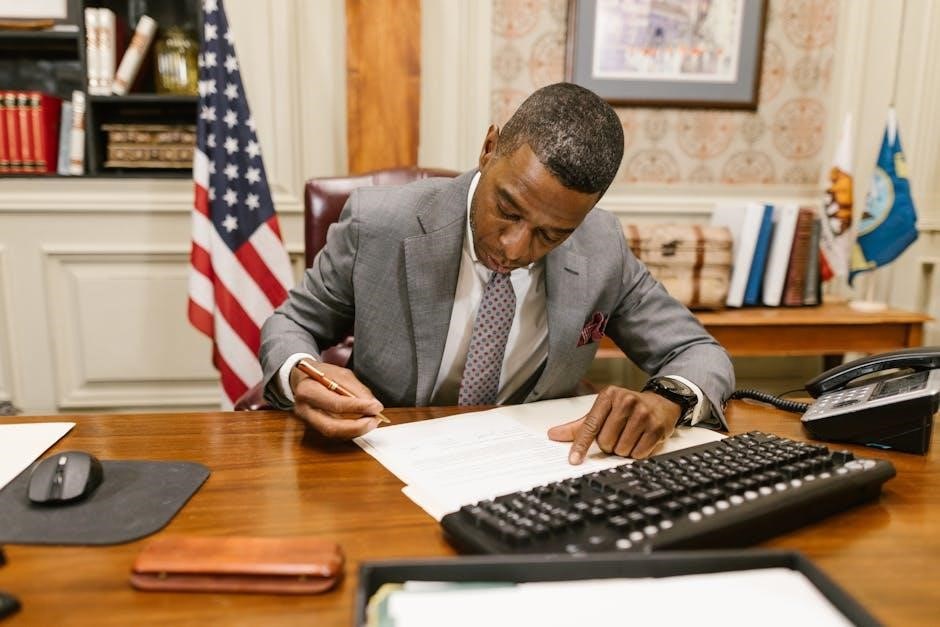

Step-by-Step Guide to Drafting the Agreement

Begin by selecting a lease-to-own contract template and fill in property details, lease duration, and purchase options. Outline rent, payment terms, and responsibilities for maintenance. Include clauses for default and termination, ensuring legal compliance. Define the option fee and purchase price, specifying how rent credits apply. Both parties should review and sign the document, with witnesses or notarization if required. Customize the template to meet specific needs, ensuring clarity and mutual understanding. Legal counsel can assist in drafting or reviewing the agreement to ensure enforceability and protection of interests.

Essential Clauses to Include

An effective lease-to-own contract must include property description, outlining the address and type of property. The lease term and option to purchase should specify the duration and conditions for buying the property. Rent and payment terms detail the amount, due dates, and accepted methods. The option fee and purchase price clauses define upfront costs and the final sale price. Maintenance responsibilities clarify who handles repairs. Default and termination clauses address consequences of missed payments or breaches. These elements ensure clarity and protect both parties’ interests, making the agreement legally binding and comprehensive.

Legal Considerations

Lease-to-own contracts must comply with state-specific laws and regulations. Legal counsel is crucial to ensure the agreement is enforceable and protects both parties’ rights, avoiding potential disputes.

State-Specific Laws and Regulations

Lease-to-own contracts are governed by state-specific laws and regulations, which vary significantly. These laws often dictate terms such as lease durations, option fees, and tenant rights. Compliance with local statutes is essential to ensure the agreement’s enforceability. For instance, some states require specific disclosures or format requirements for rent-to-own agreements. Legal counsel should review the contract to verify adherence to regional regulations, preventing potential disputes. Understanding and incorporating state-specific rules ensures both parties are protected and aware of their obligations under the agreement.

Role of Legal Counsel

Legal counsel plays a crucial role in drafting and reviewing lease-to-own contracts to ensure compliance with state laws and protect both parties’ interests. Attorneys can help negotiate terms, clarify ambiguities, and verify that the agreement adheres to local regulations. Their expertise ensures the contract is legally binding and fair, minimizing potential disputes. Legal counsel also provides guidance on disclosures, option fees, and termination clauses, safeguarding both tenants and landlords. Engaging legal professionals is essential for a smooth and enforceable lease-to-own arrangement.

Lease-to-Own Contract Templates

Lease-to-own contract templates provide a structured framework for creating agreements, ensuring clarity and legality. They are available online in PDF or Word formats, customizable to specific needs, and include essential clauses for property details, payment terms, and purchase options, making them a practical tool for both landlords and tenants to establish clear expectations and protect their interests effectively.

Where to Find Reliable Templates

Reliable lease-to-own contract templates can be found on legal websites, real estate platforms, and document-sharing services. Websites like LegalWise, Lawrina, and official legal forums offer customizable templates in PDF and Word formats. Additionally, platforms such as Rocket Lawyer and PandaDoc provide professionally drafted agreements tailored to specific needs. Ensure the template includes essential clauses like property description, lease terms, payment details, and purchase options. Always verify the source’s credibility and consult legal counsel to guarantee the template meets local regulations and protects both parties’ interests effectively.

Customizing the Template for Your Needs

Customizing a lease-to-own contract template ensures it aligns with your specific requirements. Start by filling in property details, rental terms, and purchase conditions. Specify the lease duration, monthly rent, and option fees. Clearly outline the purchase price, payment terms, and tenant responsibilities. Use online tools or legal software to modify clauses easily. Ensure all terms are transparent and legally binding. Consulting a legal expert can help tailor the agreement to comply with local laws and protect both parties’ interests. A well-customized contract fosters a clear understanding and smooth transaction process for both tenant and landlord.

Execution and Signing of the Agreement

The lease-to-own agreement must be signed by both the landlord and tenant, with witnesses and notarization ensuring its legality and binding nature.

Parties Involved

A lease-to-own contract involves two primary parties: the landlord (lessor) and the tenant (lessee). The landlord owns the property and agrees to rent it to the tenant. The tenant pays rent and has the exclusive option to purchase the property within the agreed timeframe. Both parties must sign the agreement, ensuring mutual understanding of terms, including rent, payment terms, and purchase conditions. Clarity in roles and responsibilities is crucial to avoid disputes. Witnesses may also be required to validate the agreement, depending on local laws. This structure ensures both parties’ interests are protected.

Witnesses and Notarization Requirements

The lease-to-own contract may require witnesses to validate the agreement, ensuring both parties freely consent. Notarization is often necessary to authenticate signatures and verify identities, enhancing the contract’s enforceability. Legal counsel can assist in drafting and reviewing the agreement to ensure compliance with local laws. Witnesses and notarization provide an added layer of security, preventing disputes and ensuring clarity. Requirements vary by jurisdiction, so consulting local regulations or legal experts is essential to meet specific standards. This process ensures the agreement is legally binding and protects both parties’ interests effectively.

A lease-to-own contract offers a flexible and secure path for tenants to transition into homeownership while providing landlords with stable, long-term tenants. By outlining clear terms, responsibilities, and purchase options, it balances the interests of both parties. Properly drafted agreements ensure legal compliance and reduce potential disputes. Utilizing reliable templates and seeking legal advice can streamline the process, making it an attractive option for those seeking affordable housing solutions or steady income opportunities. This arrangement is a win-win, offering a clear pathway to ownership and financial security for all involved.